1040 Form 2024 Schedule C

1040 Form 2024 Schedule C – Note that the provided schedule is approximate, and changes may occur. Any modifications will be promptly communicated through the Commission’s website. Regular updates regarding the estimated . Don’t forget about this form when rate of $50 in 2024, credit score tracking, personalized recommendations, timely alerts, and more. Schedule E is a supplemental tax form that is submitted along .

1040 Form 2024 Schedule C

Source : pdfliner.com

Business tax deadlines 2024: Corporations and LLCs | Carta

Source : carta.com

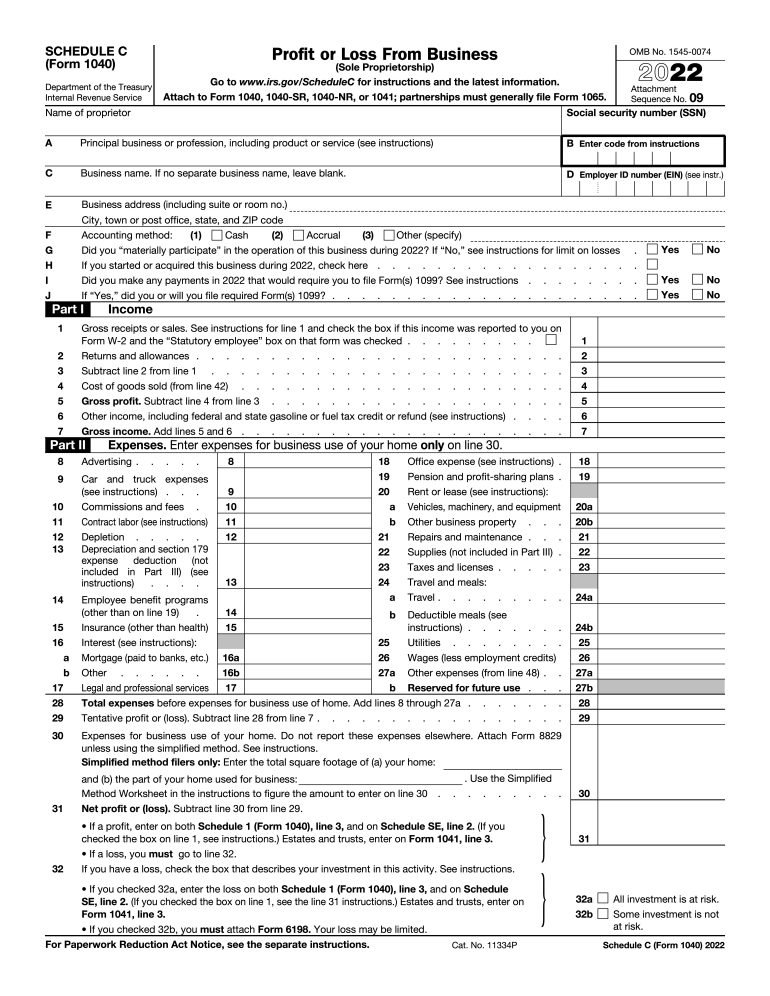

What Is Schedule C (IRS Form 1040) & Who Has to File? NerdWallet

Source : www.nerdwallet.com

Schedule C 1040 line 31 Self employed tax MAGI instructions home

Source : individuals.healthreformquotes.com

What Is a Schedule C IRS form? TurboTax Tax Tips & Videos

Source : turbotax.intuit.com

IRS Schedule C Walkthrough (Profit or Loss from Business) YouTube

Source : m.youtube.com

What Is Schedule C (IRS Form 1040) & Who Has to File? NerdWallet

Source : www.nerdwallet.com

Tax Forms For 2024 Tax Returns Due in 2025. Tax Calculator

Source : www.efile.com

Form 1040 for IRS 2023 2024 ~ What is it? Schedule A B C D

Source : www.incometaxgujarat.org

Clocktower Players Scholarship Application

Source : www.clocktowerplayers.com

1040 Form 2024 Schedule C Taxes Schedule C Form 1040 (2023 2024) | PDFliner: Salman Khan film expected to post over Rs 60 cr earning on day 2 Candidates can make corrections in the GATE 2024 application form including in fields like names, dates of birth, exam centres, gender, . Schedule C is a form that self-employed people have to file alongside their tax return, or Form 1040. “The difference between Form W-2 and Schedule C is that the W-2 is for wages earned at a job. .